Now that the government gave up

on the idea of fiscal devaluation and decided to fall back on fiscal

consolidation and, more recently, poetry, the press is awash with speculation about the

raft of alternative fiscal measures to be introduced in the new budget. Some time ago I commented on the remarkable similarities between our current financial

problems and what arguably was our most serious financial crisis in modern

times – the 1892 default. After attempting to do something completely

different, the government now seems constrained by the corset of short-term

fiscal expediency that requires immediate tax increases (perhaps with increased progressivity) and expenditure cuts where feasible, though not necessarily more

efficient.

Reading the press, I was struck

once more by how the likely options of this government resemble the choices

followed in 1892. Maybe there was no learning over 120 years of public finance

in Portugal – or perhaps the co-dependency relation between state and economy,

very obvious in the nineteenth century, is essentially still there today.

After three years of a slow-moving

balance of payments crisis with public deficits trebling relative to pre-crisis levels,

the new government empowered in January 1892 presented a radical fiscal

consolidation plan which was supposed to balance the budget in one year. In

ambition at least, our forefathers were bolder than our current plans, even

though lack of technical competence and political instability eventually

derailed these budgetary plans and postponed the consolidation by two years.

But since we are talking about proposals, it is instructive to go back and

characterise the financial plans of the government. The work of an outsider to government

politics, Oliveira Martins (one of the leading intellectuals of the nineteenth

century, who had been given the job of finance ministry precisely because of

that), the new budget aimed at inverting the budgetary position to the tune of

more than ten thousand contos in one

year. For perspective, this represented about a quarter of the total revenue raised

the year before. Again this was a much larger consolidation than the current

plans signed off by the ‘troika’. But despite the differences in scale, the

proposed measures have all been experimented by the last two governments since

2010.

Starting with salary cuts for

civil servants, Oliveira Martins introduced them by noting this was not a new

idea, having been previously applied in 1848 and again in 1852. In his version,

civil servants earning more than 400 mil-réis per annum (roughly €8000 in today’s money) would have their

salaries cut by a sliding scale starting at 5% and going up to 20% for those earning

1500 mil-réis or more. If we add up the original sliding scale of civil

servants’ cuts to the recently outlawed cut of the two subsidies, the scale

of sacrifice is very similar, with contemporary salaries being cut by a maximum

of 24%. If anything, progressivity was steeper in 1892 as the ratio between the

income thresholds of the highest and lowest taxed brackets was higher then than

it is today (3.8 vs. 2.7).

Pensioners were also not

forgotten in the new budget and they had to go through cuts along the same

scale as active civil servants. Moreover, annual pay for state employees was capped

at 2 contos (2000 mil-réis) per year

for active civil servants and 1500 mil-réis for retirees. The difference in

caps created some protests, namely among republican deputies, who took the

opportunity to notice the ingratitude of the monarchy for its most loyal servants

once it no longer needed them!

Equally contentious were the

exceptions to this cap, which included ministers and high officers of state,

the church, and the military. Contrary to today, there was no opposition

to cutting the salaries of judges, even though the separation of powers had

also been adopted in the Constitutional Charter of 1826.

Civil servants were also

prevented from accumulating retirement pensions with other state stipends

– a recurrent problem apparently, which the current government had to fight

again. Continuing with similarities, the budgetary law froze the hiring,

promotion and jubilation of state employees, without exception. As we know,

these days some ‘autonomous’ state services, state-owned firms, and as rumoured

today, even university professors have been more successful at avoiding

the contemporary freeze.

But the meat of the 1892 budget

lied more on the side of revenue than expenditure, with a tax increase

across the board. The government paid the usual lip service to the idea of

saving on taxpayers’ money by finding economies through rationalising existing

services, but apart from salary cuts this was more a pious hope than a budgeted

reality, though the finance minister assured Parliament that he was already

studying ways of cutting waste for the next budgets. To finalise the

expenditure side, the government also deferred 3000 contos of capital expenditure.

The recent social rebellion

against the changes in payroll taxes (TSU) raised the issue of the equity in

the distribution of tax increases. How did the government solve this problem in

1892? Although raising all tax rates, the government used progressive scales in

almost all of them, with the exception of the income taxes on capital

investment and interest on bank deposits. The highest increases were also

concentrated on the luxury tax, the property tax and the tax on capital

investments (especially in government debt). In fact, some deputies rose in

defence of the poor fate of investors

who, together with civil servants, were more severely burdened than everyone

else. However, it was easy for the government (then as today) to dismiss this by arguing that investors were usually among the wealthiest taxpayers

and that civil servants had protected jobs compared to their private sector

equivalents.

To finalise with eerie

resemblances, the government also introduced two new taxes on vice. Tobacco, a

recently rediscovered solution for our problems, had already been exhausted

as a quick fix by the previous government, so the finance minister

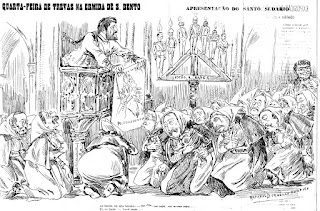

turned instead to a complementary good (matches) and alcohol. Portuguese readers can get an idea

of the total sharing of burdens from the summary in the next chart.

Basically, tax increases were roughly of the same order as expenditure cuts (3562 contos against 3800), a proportion the IMF would certainly approve. But the missing element in today’s plans, a haircut of the Portuguese sovereign debt (as Greece obtained last year) was actually the largest item on the balance, estimated to be worth more than 5000 contos, or about 40% of the total fiscal consolidation. As I write this, the idea of opening up a renegotiation of Portuguese debt is still rejected by the government, the troika, and most economists and politicians alike. However, a recent analysis by Harald Hau and Ulrich Hege suggests that sovereign default, especially if used early, is a better option than the alternatives of fiscal austerity and intra-European solidarity. Hau and Hege’s article, although only posted on the 8 September is already one of the most viewed ever in the Vox EU site. Perhaps this is an internet premonition of things to come, but I believe the authors have too candid a view of what a sovereign default entails, especially in the context of the Eurozone. That, however, will have to remain for another time.

Until then, we may as well join Oliveira Martins, who contrary to the current Prime Minister did not need to quote Camões to give a poetic interpretation to the nation's plight, and placed his greater trust on «the same self-denial, the same loyalty, and this firm resistance against adversity, which was always one of the arms of the Portuguese spirit.»

Are you in need of finance? we give out guarantee cash at 3% interest rate. Contact us on any kind of finance now: financialserviceoffer876@gmail.com whatsapp Number +918929509036 Dr James Eric Finance Pvt Ltd

ReplyDelete